If you are working to improve young people’s understanding of money, high quality resources are a great place to start. Below you will find tools and Quality Mark resources produced by us and the organisations we support that can be used by educators in formal and non-formal settings, parents/carers and children and young people themselves.

Please note: We are currently unable to ship resources outside of the UK. We are sorry for any inconvenience this might cause.

Find out more about the Quality Mark

16 – 18 Quality Mark

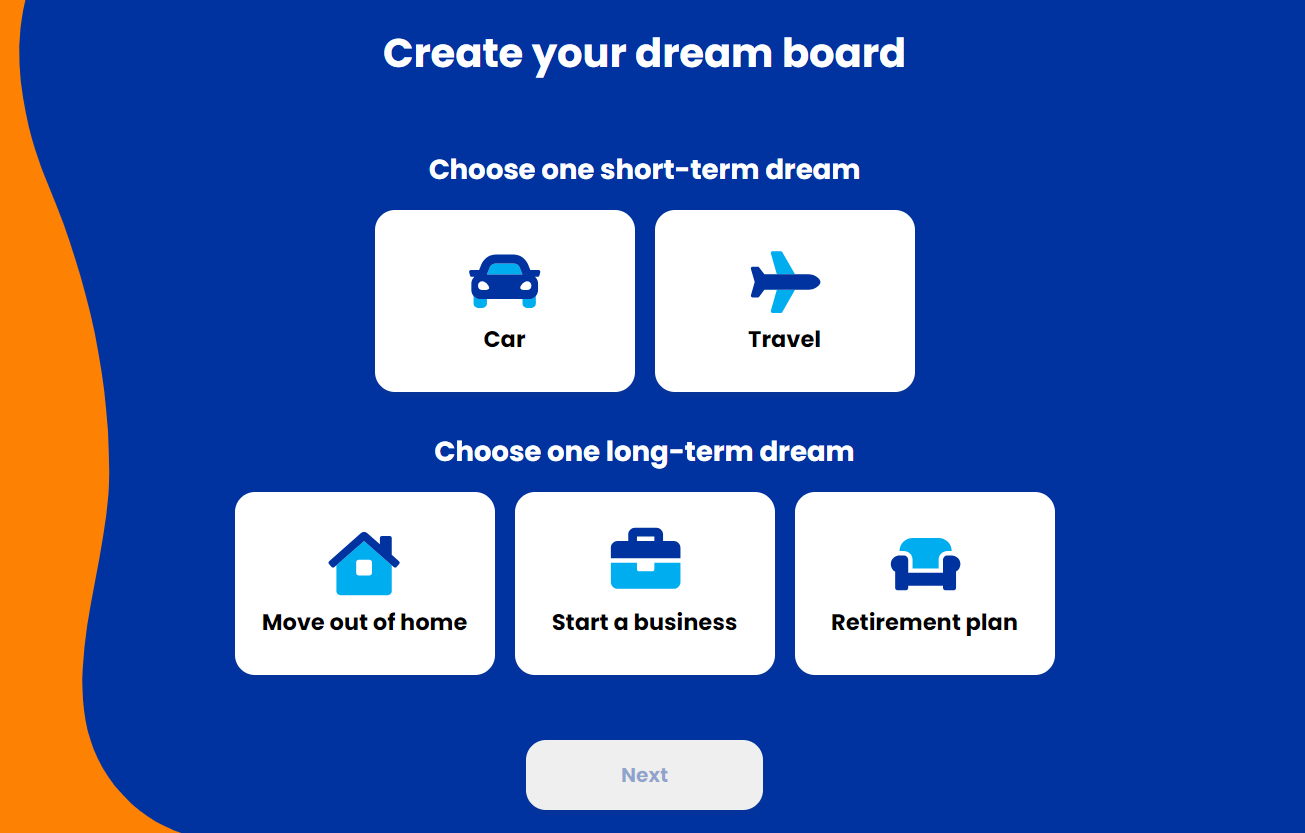

Access to the Raise Web App here - Teacher Support Guides can be accessed through the download button above. The Raise Web App and Teacher Support Guides are designed to take students on a virtual journey spanning the next forty years of their lives. Along this journey, students will be shown how saving and investing long-term could help them achieve a better and more secure financial future. They have goals to achieve, financial decisions to make, and scenarios to explore.

8 – 12

The Island Saver game is a fantastic tool for engaging young people with financial topics in an exciting and innovative manner. This involves discovering various ‘bankimals’ (piggy-bank-themed animals) and helping them with tasks and challenges, the rewards of which can be spent or saved. The parent guides provide opportunities for parents to engage with their children within the context of the game and bolster their learning.

7 – 16 Quality Mark

A suite of five financial education lesson plans intended for delivery to a range of ages from year 4 to Year 11.

7 – 11 Quality Mark

Please note: Hard copy orders are placed in quantities of 60 workbooks per pack.

Starting in 2022, Ysgol Pentrecelyn’s Key Stage 2 collaborated with Young Enterprise to deliver a financial education project that reflected the specific needs and interests of their rural community. The need for the project arose from the school’s development plan (SDP) following the pandemic, which identified the impact on learners’ numeracy and financial capabilities.

11 – 19 Quality Mark

A resource centred on the activities of people who lend money illegally, applying a wider framework of personal finance education dealing with the general topics of staying safe, credit and debt and budgeting.

5 – 11 Quality Mark

A resource centred on the activities of people who lend money illegally, applying a wider framework of personal finance education dealing with the general topics of staying safe, credit and debt and budgeting.

13 – 19 Quality Mark

Our online courses are designed to support young people to develop the vital skills they need to get into employment, earn and look after their money. Suitable for learners aged 13-19, each course is structured around a series of units, providing young people with multiple opportunities to learn, do and review. Based on the Your Money Matters textbook, over 6 online units, My Money Matters provides students with the opportunity to explore their own attitudes to money and gain key financial skills to help them in the real world.

16 – 18 Quality Mark

Young Enterprise has partnered with digital investment firm, Wealthify, to create Future Skills: a fun teaching resource designed to help educators teach 16 to 18-year-olds about the basics of money.

3 – 11

Young Enterprise’s Practical Guide to Reviewing Financial Education for Primary School Leaders is a tool designed to help primary school leaders and teachers looking to embed financial education in the classroom.